Juaben Rural Bank PLC has held it’s 38th Annual General Meeting, which also marks the grand finale of the bank’s 40th-anniversary celebrations. Thanking the Almighty for His grace and guidance over the years. The leadership of the bank also extend their heartfelt gratitude to Nana Otuo Siriboe II, the Omanhene of Juaben Traditional Area, whose visionary leadership laid the foundation for what we celebrate today. The Board Chairman of Juaben Rural Bank PLC also acknowledge the selfless service of past and current board members and directors, whose efforts have been instrumental in bringing the Bank to its current success.

The Board Chairman of Juaben Rural Bank PLC, Nana Appiagyei Danka-Woso I gave an account of the banks process for the year.

Operating Environment:

In 2023, Ghana’s economy showed gradual recovery, following the Domestic Debt Exchange Programme (DDEP). The Ghana cedi faced some depreciation early in the year but remained relatively stable. Interest rates trended downward, with Treasury bill rates declining from 2022 levels. Inflation decreased significantly to 23.2% in December 2023, down from a peak of 54.1% in 2022. The Bank of Ghana’s monetary policy rate increased to 30% by the end of 2023 from 27% in 2022.

Financial Review:

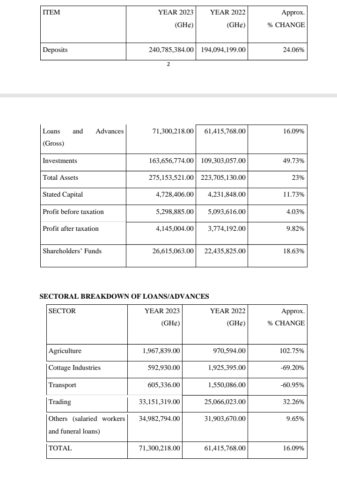

The Bank’s financial performance for the year ended December 31, 2023, showed promising results. The Directors recommend a dividend of GH¢0.07 per share, totaling GH¢1,125,053.00, reflecting a 27.14% payout of the profit after taxation. We are grateful to the Bank of Ghana for granting approval for dividend payment, subject to shareholders’ approval.

The Bank’s stated capital grew by 11.73%, from GH¢4,231,848.00 in 2022 to GH¢4,728,406.00, and has since exceeded GH¢5.8 million as of October 2024. The increase in capital positions the Bank well for future growth. Additionally, profit before tax has more than doubled, and the fundamentals remain strong, which offers potential for future capital gains for shareholders.

Board of Directors:

We announce the retirement of two distinguished board members, Nana Owusu-Poku and Oheneba Yaw Sarpong Siriboe, who have served with dedication. We also inform shareholders of the ongoing process for the appointment of Mr. Victor Kusi as a Director, subject to Bank of Ghana approval. In compliance with corporate governance directives, Ms. Lena Adu-Kofi has been co-opted onto the Board, becoming our first female director, bringing valuable expertise from her extensive experience in insurance broking.

Corporate Social Responsibility:

Juaben Rural Bank continues to demonstrate its commitment to community development. In 2023, we spent GH¢105,000.00 supporting various initiatives, including scholarships, farmers’ day celebrations, and contributions to the education sector. We also supported community projects such as the Juaben Daamang Landscaping Project.

Awards:

We are proud to announce that Juaben Rural Bank has been recognized among the top 100 companies in the country in the prestigious Ghana Club 100 rankings. Additionally, we were named the Chamber Rural Bank of the Year 2023 at the Ghana National Chamber of Commerce and Industry Business Awards.

Training Centre Project/Human Capital Development: The Bank continues to invest in its workforce with a new training center at our Head Office. Our human capital development strategy is evident in our increasingly skilled workforce, which includes certified professionals in various fields. We remain committed to encouraging our staff to pursue further professional and academic qualifications.

Security:

To enhance security, we have procured a new Toyota Land Cruiser LC 79D armoured bullion van for cash-in-transit operations, in compliance with Bank of Ghana’s directives. We also acknowledge the support of the Ghana Police Service and Mangadah Security Services in providing security.

Technology:

In a rapidly evolving digital landscape, the Bank has continued to invest in robust ICT infrastructure. This will help us improve operational efficiency and enhance the customer experience.

Branch Expansion:

The Bank is expanding its footprint, with a new agency office under construction in Kumasi, expected to open soon. This strategic location will allow the Bank to offer a broader range of services to customers.

40th Anniversary Celebrations: The Bank’s 40th anniversary celebration under the theme “40 Years of Sustainable Banking” has been marked by various events, including a tree planting project aimed at combating global warming. We plan to plant 40,000 trees over the next five years. Additionally, clean-up exercises have been carried out in collaboration with local assemblies.

Outlook:

With 40 years of resilience, we are confident that the Bank’s growth will continue. We will focus on expanding into new growth areas, leveraging technology to enhance customer experience, and promoting sustainability in all aspects of our operations. We aim to be the most preferred rural bank in the country.

Conclusion:

On behalf of the Board, I extend our deep gratitude to all those who have supported us over the years. We thank the Omanhene, the Bank of Ghana, our shareholders, customers, business partners, and all stakeholders. A special thank you to the Management, Staff, and fellow Directors for their tireless contributions.

Nana Appiagyei Danka-Woso I- Board Chairman, Juaben Rural Bank PLC

Story by Gifty Badu Boakye

ProudGhana.com Latest News, Politics, Sports, Entertainment & More

ProudGhana.com Latest News, Politics, Sports, Entertainment & More